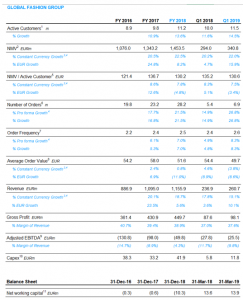

Luxembourg, 13th May 2019 – Global Fashion Group S.A. (GFG), the leading online fashion and lifestyle destination in growth markets, has delivered a strong quarter. Q1 2019 saw Net Merchandise Value (NMV) grow by 22.0% year on year (YoY) to €341 million on a constant currency basis and Active Customers reached 11.5 million, growing 14.5% YoY.

Revenue reached €261 million, growing 15.1% YoY on a constant currency basis in the first quarter of 2019. We delivered this growth inside our disciplined financial model, using our growing scale and operating leverage to continue making progress towards break-even. Our adjusted EBITDA margin reached (9.8)%, an improvement of 1.9 ppts YoY.

Christoph Barchewitz and Patrick Schmidt, Co-Chief Executive Officers, said: “It has been a quarter of strong growth for GFG. We continue to build our online platform for fashion & lifestyle brands to access growth markets and now have over 10,000 brand partnerships. We are seeing strong growth in Active Customers as structural adoption of mobile and e-commerce continues across our markets. Our customers are also buying more, and more often, as we use technology and our unique distribution network to make buying fashion online a frictionless part of every-day life. We continue to invest in the overall customer experience and our operational infrastructure to underpin our continued growth and progress to profitability.”

Strong growth in loyal customer base

With Active Customers for the Group reaching 11.5 million in the first quarter of 2019, NMV per active customer also grew by 7.5% on a constant currency basis. Orders showed strong growth, rising by 26.8% to 6.9 million, with order frequency going up by more than 8% compared to the same period last year.

Continued growth in our Marketplace

Q1 2019 showed continued growth in our Marketplace business. Marketplace share of NMV grew to 19% in the first quarter of 2019. This growth in Marketplace contributed to improved gross margins of 37.6% in Q1 2019 (37.0% Q1 2018).

Step forward to improved profitability

Our adjusted EBITDA loss improved to €(26) million, representing (9.8)% of revenue, an improvement of 1.9 ppts. Before adjusting Q1 2018 for the proforma impact of IFRS 16, the improvement was 3.8 ppts.

Continued investment enabled by solid financial position

We made capex investments of €12 million in Q1 2019 focused on our inhouse technology capabilities and fulfillment infrastructure.

The closing cash position at the end of Q1 2019 was €178 million including €75 million of restricted cash and cash on deposit, primarily related to our RCF facility, which remains undrawn. As previously announced, we disposed of our remaining interest in our Middle Eastern business, Namshi in Q1 2019 and received net proceeds of €114 million.

Segment overview

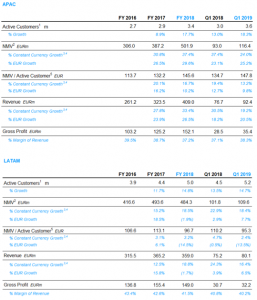

APAC

Q1 2019 was a strong period across the region, driven by investment in the overall customer experience. Active Customers grew by 18.3% YoY to 3.6 million. NMV per Active Customer also grew strongly by 13.2% on a constant currency basis.

Q1 2019 NMV of €116 million represented constant currency growth of 24.0% YoY. Revenue of €92 million represented 19.2% growth YoY on a constant currency basis and Q1 gross margin increased by 1.2 ppts. to 38.3%.

Q1 2019 saw ZALORA further cement its position as the go-to-destination for modest wear in Singapore, Malaysia and Indonesia, through the roll out of the ZALORAYA 2019 campaign in March, which together with our other in-house brands Zalia and Lubna, complements our collection of over 30 exclusive designer collaborations launched per year in South East Asia. ZALORA Indonesia launched ZNOW, making Express Delivery a reality across all core markets. Further enhancing the customer experience at THE ICONIC, we recently launched THE ICONIC Considered, an industry leading initiative, enabling our customers to filter shop based on their personal sustainability values. The range launched with over 6,400 products tagged with sustainability credentials across 300+ brands, with new products holding sustainability credentials added daily.

LATAM

Active Customers in LATAM reached 5.2 million, increasing 14.7% YoY. NMV per Active Customer increased marginally on a constant currency basis.

Q1 2019 NMV reached €110 million, an uplift of 18.4% from Q1 2018 on a constant currency basis. LATAM achieved Revenue of €80 million in Q1 and the gross margin decreased by (0.6) ppts. to 40.2% driven by country mix.

Following the launch of Dafiti bicycles in Chile in Q4 2018, we are now testing this service in Brazil, with the aim of rolling this out across more markets. This reinforces our commitment to offering alternative delivery methods to our customers as well as our care and respect for the environment.

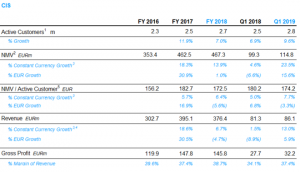

CIS

In our CIS region, Active Customers grew by 9.6% YoY reaching 2.8 million, with NMV per Active Customer growing 7.7% on a constant currency basis. Q1 2019 NMV of €115 million represented a growth of 23.5% from the same time last year on a constant currency basis.

Revenue reached €86 million in the first quarter of 2019, with a constant currency growth of 13.0%. Our Q1 2019 gross profit margin increased by 3.3 ppts YoY to 37.4%. Contributing to this is our continued focus and investment in our premium brand assortment, which saw the Average Selling Price (ASP) increase significantly in line with strategy.

About Global Fashion Group

Global Fashion Group (“GFG”) is the leading fashion and lifestyle destination in Asia Pacific, Latin America and CIS. We connect over 10,000 global, local and own brands to a market of more than one billion consumers through four established e-commerce platforms: The Iconic, Zalora, Dafiti and lamoda. Through an inspiring and seamless customer experience enabled by our own technology ecosystem and operational infrastructure, we are dedicated to being the #1 fashion and lifestyle destination in our markets. With 18 offices and 10 fulfilment centres across four continents, GFG proudly employs a dynamic and diverse team with deep local knowledge and expertise. In the last twelve months, GFG delivered over 29 million orders to over 11.5 million active customers, generating Net Merchandise Value of approximately €1.5 billion. For more information, visit http://global-fashion-group.com

Notes:

- Number of customers who have purchased at least one item after cancellations, returns and rejections in the last twelve months

- Value of goods sold after cancellations, rejections and returns including VAT/GST and delivery fees

- Growth rate is shown on a constant currency basis and therefore excludes the effect of foreign currency movements

- To ensure comparability between periods we have adjusted prior periods for acquisitions, disposals and corporate restructurings and adjustments for the impacts of hyperinflation

- Last twelve months’ NMV / Active Customers

- Number of orders placed by customers after cancellations, rejections and returns

- Average number of orders per customer per year (calculated as last twelve months’ orders divided by active customers)

- Net Merchandise Value (NMV) per net order

- Adjusted EBITDA is calculated as operating profit or loss before depreciation of property, plant and equipment, amortisation of intangible assets, impairment losses, share-based payment expenses, a one off provision release and one off costs. Q1 and FY 2018 adjusted for the proforma IFRS16 impact

- Capital expenditure represents the acquisition of property, plant and equipment and intangible assets in the reporting period

- Net working capital represents inventories and trade and other receivables less trade and other payables and other financial liabilities.