Luxembourg: Global Fashion Group S.A. (GFG), the leading online fashion and lifestyle destination in growth markets, delivers exceptionally strong Q3 revenue, NMV and gross margin growth, driving a consecutive quarter of Adj. EBITDA profitability and cash generation.

| Q3 2019 | Q3 2020 | YTD 2019 | YTD 2020 | |

|---|---|---|---|---|

| Revenue €m | 325.1 | 336.5 | 928.3 | 944.1 |

| % Constant Currency Growth* | 18.7% | 20.6% | 16.9% | 13.7% |

| % € Growth | 22.8% | 3.5% | 16.1% | 1.7% |

| NMV €m | 433.8 | 503.4 | 1,224.0 | 1,363.8 |

| % Constant Currency Growth* | 24.1% | 34.5% | 23.0% | 24.2% |

| % € Growth | 29.2% | 16.0% | 22.3% | 11.4% |

| Gross Profit €m | 131.5 | 149.5 | 370.9 | 403.2 |

| % Margin of Revenue | 40.5% | 44.4% | 40.0% | 42.7% |

| Adjusted EBITDA €m | (9.1) | 10.3 | (37.8) | (2.9) |

| % Margin of Revenue | (2.8%) | 3.1% | (4.1%) | (0.3%) |

Q3 2020 Highlights

(growth rates at constant currency)

- Net Merchandise Value** (“NMV”) increased by 34.5% to €503.4m, revenue up 20.6%

- Marketplace NMV grew by 113% yoy, achieving 34% participation (Q3/19: 22%)

- Adjusted EBITDA of €10.3m, a margin of 3.1%, and the most profitable quarter to date

- Cash flow positive with pro-forma*** cash balance at 30 September of €281m, up €18m in the quarter

- Strong Active Customer growth of 24.2% to 15.4m, with NMV per Active Customer of €124.2

- Orders increased by 26.3% to a record 10.8m, with a 6.5% increase in average order value, and customer frequency steady at 2.5 times per year

Christoph Barchewitz and Patrick Schmidt, Co-CEOs of GFG, said: “Q3 was one of our strongest quarters since the start of GFG almost 10 years ago and we are very pleased to have increased NMV by 35% while also improving Gross Margin and Adjusted EBITDA significantly. Thanks to a fast pivot into ‘lockdown categories’ and by growing our Marketplace business, we were able to deliver our second cash positive quarter. These results are a real testament to the resilience of GFG’s business model, the agility of our operations, and our people who have adapted well to new ways of working, and we are very grateful for their excellent work during these extraordinary times.”

Outlook

On 11 November 2020, reflecting the strong start to the fourth quarter, GFG updated its guidance for full year 2020. GFG expects to achieve constant currency NMV growth of around 25%, giving just over €1.9 billion NMV and €1.3 billion of revenue. Adjusted EBITDA is expected to be at least €10 million. Capex investment will be around €45 million. This guidance is based on the current currency exchange rates.

Strong new customer and marketplace growth continues to accelerate GFG strategic progress

In the third quarter, GFG achieved its highest NMV growth in four years. Consumers continued to shift online in significant numbers, with 1.9 million new customers shopping across GFG’s platforms. Marketplace NMV increased by 113% yoy and participation now represents 34%, as even more brand partners engaged with this channel to build their online presence.

LATAM had a standout performance at 52.1% NMV growth, while SEA and CIS saw uplifts of 34.0% and 31.8%, respectively. Pleasingly, ANZ saw an uplift from Q2 and achieved NMV growth of 12.8%, although lack of inventory remains a challenge there. During the quarter, THE ICONIC OUTLET and the beauty category were successfully launched in ANZ.

GFG delivered a record number of orders – 10.8 million in the quarter – a 26.3% increase yoy, while the average order value grew by 6.5% at constant currency. Customer frequency was 2.5 orders per year.

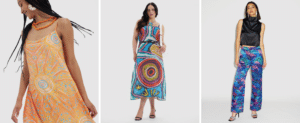

During Q3 GFG launched an own-brand sustainable capsule collection in South East Asia, and also launched its second sustainable shopping edit having launched the Considered edit in ANZ in 2019.

Key Performance Indicators

| Q3 2019 | Q3 2020 | YTD 2019 | YTD 2020 | |

|---|---|---|---|---|

| Active Customers m | 12.4 | 15.4 | 12.4 | 15.4 |

| % Growth | 15.0% | 24.2% | 15.0% | 24.2% |

| NMV / Active Customer € | 134.9 | 124.2 | 134.9 | 124.2 |

| % Constant Currency Growth | 6.9% | (0.5%) | 6.9% | (0.5%) |

| % € Growth | 4.0% | (7.9%) | 4.0% | (7.9%) |

| Number of Orders m | 8.5 | 10.8 | 24.3 | 28.8 |

| % Growth | 20.8% | 26.3% | 24.2% | 18.3% |

| Order Frequency | 2.6 | 2.5 | 2.6 | 2.5 |

| % Growth | 7.5% | (4.3%) | 7.5% | (4.3%) |

| Average Order Value € | 50.8 | 46.7 | 50.4 | 47.4 |

| % Constant Currency Growth | 2.8% | 6.5% | (0.9%) | 5.1% |

| % € Growth | 6.9% | (8.1%) | (1.5%) | (5.8%) |

*Euro reported results were significantly impacted by the devaluation of two of the Group’s main trading currencies, the Russian ruble and Brazilian real. Growth at constant currency provides the underlying performance of the Group.

**NMV is the value of both retail and Marketplace merchandise being sold through our platforms. Revenue, is the retail value plus the commission earned on a Marketplace transaction, and is therefore disconnected from true volume.

***Includes restricted cash of €6m related to buyer loan facilities in place in SEA and ANZ at the end of the period and approximately €11.9m drawn on local working capital facilities (Q2/20: €20m and €10.5m, respectively).

FURTHER INFORMATION

KPI and financial definitions, including alternative performance measures are available in the H1 2020 Interim Management Report.

For inquiries please contact:

Press / Communications

Christina Song, Strategy Director

[email protected]

Investor Relations

Adam Kay, Investor Relations Director

[email protected]

FORWARD-LOOKING INFORMATION

This announcement contains forward-looking statements. Forward-looking statements should not be construed as a promise of future results and developments and involve known and unknown risks and uncertainties. Various factors could cause actual future results, performance or events to differ materially from those described in this announcement, and neither the Company nor any other person accepts any responsibility for the accuracy of the opinions expressed in this announcement or the underlying assumptions.

ABOUT GLOBAL FASHION GROUP

Global Fashion Group is the leading fashion and lifestyle retail destination in LATAM, CIS, SEA and ANZ. We connect over 10,000 global, local and own brands to a market of more than one billion consumers through four established ecommerce platforms: dafiti, lamoda, ZALORA and THE ICONIC. Through an inspiring and seamless customer experience enabled by our own technology ecosystem and operational infrastructure, we are dedicated to being the #1 fashion and lifestyle destination in our markets. With 17 offices and 10 fulfilment centres across four continents, GFG proudly employs a dynamic and diverse team with deep local knowledge and expertise. In the twelve months to 30 September 2020, GFG delivered 39.1 million orders to 15.4 million Active Customers. (ISIN: LU2010095458.)